Dancing to Inflation’s tune

9 November 2021

Inflation is a well-established factor in the economic and investment dance of life. Yet for the last 40 years it has been largely absent. Now, Inflation seems to have re-entered the Ball’s playlist. During this interim, many investors may have forgotten the appropriate steps.

Generally speaking, Bond investments are likely to yield dismal returns. Thus, investors have diverted their funds into the already price-inflated Equities markets

Equities have seemingly become the investment of last resort. Caveat emptor!

In addition, many present-day Investors consider Equities themselves to be a hedge against Inflation; the theory being that companies can pass on price rises to customers and consumers. These Investors acknowledge that Inflation rates are uneven and thus take solace from a diversified portfolio of stocks. In the current market context, the seemingly more resilient sectors (eg financials, commodities, energy etc).

Yet this approach to Inflation’s staccato tune may well be inappropriate.

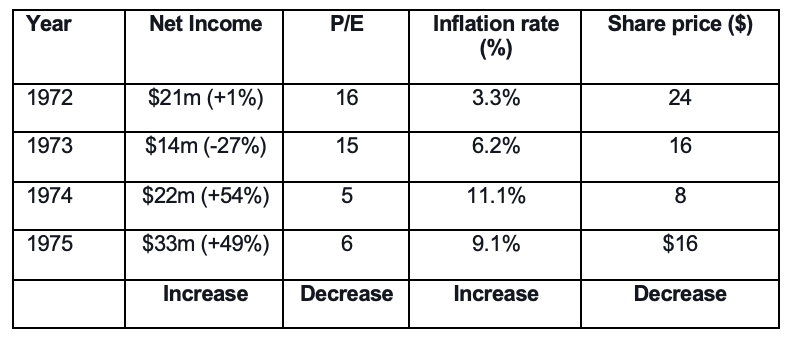

A deeper analysis shows that even for the more resilient Equity stocks the effect Inflation may well have is to depress Price-to-Earnings (P/E) multiples and hence valuations. A look at Hersey, the confectionary company (and a ‘natural hedge), from the 1972 -1975 period (the peak of the last major Inflation dance) shows the following pattern of Inflation-induced, value erosion (see Chart 1). Despite importing operational performance during a period fo sustained Inflations. Hershey’s value fell.

Chart 1: Hershey (1972-75): Operational performance, and Valuation and Inflation

Sources: Inflation; Hersey

To apply this pattern to the present-day is instructive. For example, using a current, stalwart company of the Equity markets, Microsoft. The analysis indicates that Inflation could exert an economic risk premium, reducing Microsoft’s current 34 P/E ratio to a 20 level: a 40% reduction, due largely to the ravaging effects of Inflation.

There are many commentators who are expressing their views with regard to the corrosive effects of Inflation on value, for example Minock. A further simple analysis of the effects of Inflation on Equity valuations reveals a compelling relationship (see Chart 2)

Chart 2: Inflation and Equity Valuations

Given the relationship revealed in Chart 2 and current inflationary dynamics, the potential fall is precipitous.

Equity de-rating is a concern., even for the most resilient of companies,

More worryingly is the starting position of ‘Today’, which is represented by the orange ball (in the top-left quadrant, 2:30). The degree of possible reduction is significant.

As Sanjay Ranchhoddas, Portfolio Manager at Gate Capital Group, likes to quote the analyst at Ruffer: “Inflation doesn’t just rot an apple, it blights the orchard”. Give Sanjay, or his ilk, a call to complete you dance-card.

*

Justin Jenk is a business professional who enjoys discovering and connecting dots.