From shortage to glut: who is to blame?

23 November 2021

While the headlines, since March 2021, have referred to the broadening effects of the semiconductor (chip) shortage; little discussion has been given to the underlying reasons. Closer examination of the causes may see the current shortage quickly change to a glut; with Deflationary pressures. A classic whipsaw effect. Read on!

Confused reporting

The popular press has tended to cite the reasons for the prevailing chip shortage as being: foundry concentration (in Taiwan); geopolitical tensions; the fragility of global supply chains as well as; (wait for it) - “weaponised integration” …hmmh! Most of these reasons explain only part of the story.

Regardless of reason, the effects of the current shortage are clear. Goldman Sachs estimates that over 196 industries are negatively affected, with Automotive manufacturers (their suppliers and related satellite companies); household appliances as well as Consumer electronics feeling the greatest pressure. The net effect has been “shortages”, with rising retail prices, stoking Inflationary pressures.

Yet, the supply shortages are happening in the context of “…the highest level of global manufacturing output ever seen” according to sources at Nuveen.

A more nuanced understanding may provide insights and thus opportunities for Investors.

Self-induced, positive shock

The reality of the “crisis” suggests that the “shortage” is self-induced: due to poor ordering as well as planning by manufacturers; not failures of the chip producers.

In March 2020, the Automotive industry saw demand slump and cancelled its orders for chips. By December 2020, demand had rebounded and there was a scramble to source the lack of chips. It the same period, Consumer Electronics saw a surge of demand from stay-at-home consumers for: game consoles, TVs, smart phones, modems and routers. A classic economic scissor-snap.

Thus, the world economy is experiencing a problem of a ‘positive demand shock’: too much demand for current supply. This type of “shock” is better than the reverse, ‘negative’ shock; where there is too little demand for the set supply.

Still the shortage pattern is likely to be exacerbated by human nature (being what it is). Despite planning disciplines one is witnessing double and even triple ordering (for the same part/component/chip). This behaviour further aggravates the current “shortages”. These surpurfulous orders may well be cancelled by the Spring of 2022, but these damaging effects are already part of the supply chain flow. It could result in a glut; with oversupply and price deflation.

This whip-saw, just as with phantom traffic jams on a high-speed road, is due to small stop/start actions and changing densities of flows (Chart 1: Jamitron). In Physics this dynamic is termed a soliton wave; related to Lorenz curves and the more familiar boom & bust cycles.

Chart 1: Soliton wave , or in this case “Jamitron” for phantom traffic jam: small chages have recurring wave effects

For global supply chains, bottlenecks have formed; such as port discharge times, where the pre-Covid average of 3.9 days has nearly doubled to 6.4 days.

A further effect might be a structural increase in factor costs; as manufacturers relax their lean Just-In-Time practices, holding more inventory for critical components. Such a change might depress earnings.

The recent announcements by the Semiconductor producers for capital intensive, long lead time capacity additions may see market capitalisation erosion in the medium term. As with many other capital-intensive industries (such as Shipping), the Semiconductor industry is no stranger to these insidious cycles of boom & bust.

Investors?

For Equity stock Investors the period up to December 2021 may be a lull before a literal New Year correction; as Cathie Wood, of ARK fame, suggests.

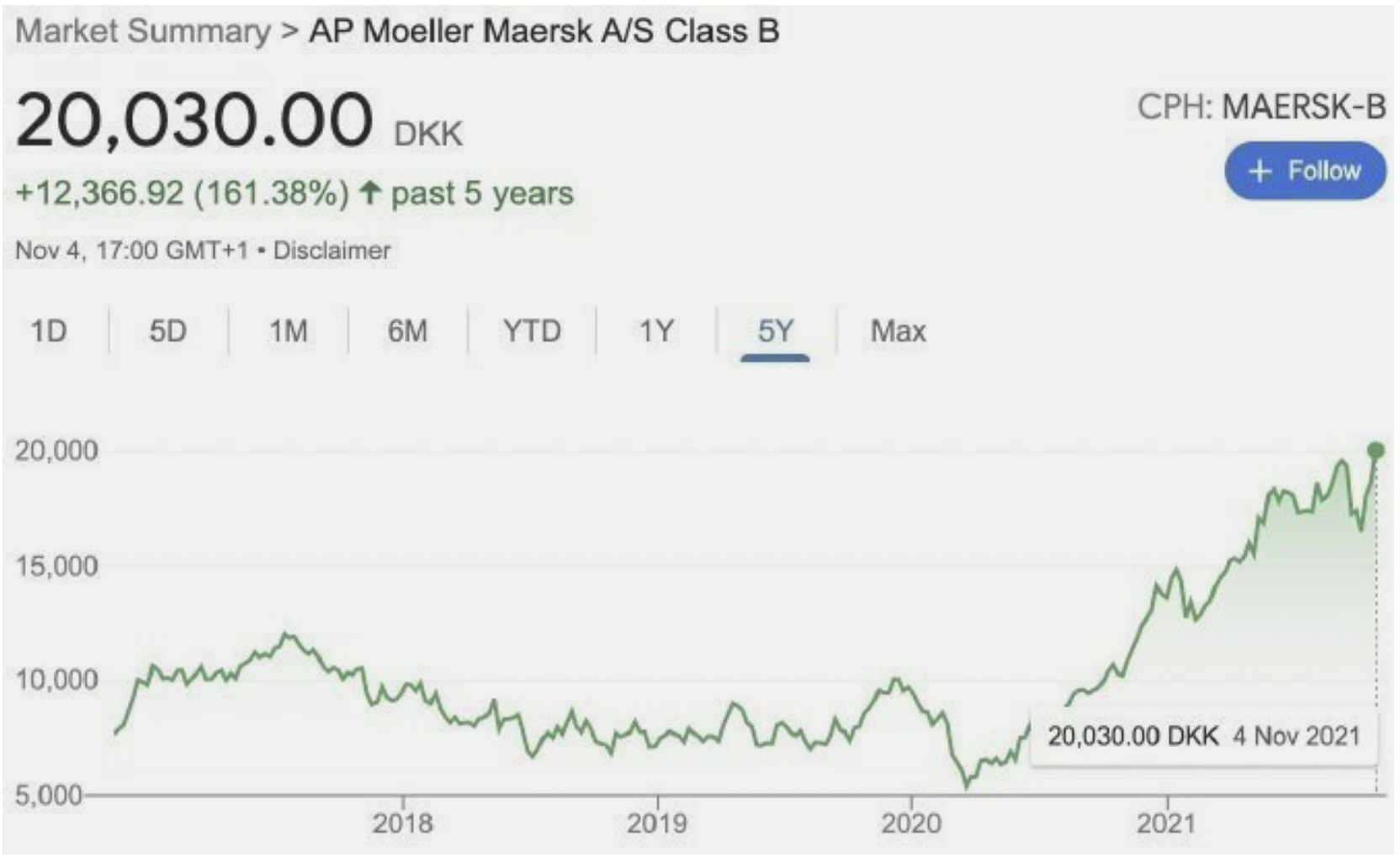

For Transportation companies, one has already seen this shortage play out. For example, in Ocean Shipping the collective share prices have nearly doubled in the last twelve months (across general, container and specialty fleets); reaching all-time-highs. A.P. Møller/Maersk, the world’s largest shipping company, is such an example (Chart 2). Is this jump in valuation justified, sustainable?

Chart 2: Maersk share price, 2017-2021, DKK

Is this jump in valuatrion justifiable? For a logistics company?

However, the period to December may offer an interesting inflection for the following transportation-oriented companies: UPS; Uber technologies; XPO Logistics; Matson; Atlas Air Worldwide and Scorpion Tankers.

Other more obviously affected sectors may also provide opportunities, such as individual Automotive manufacturers (GM), and Retailers (such as Wal Mart, Home Depot). It is interesting to note that the recent precipitous decline in Bed Bath & Beyond’s share price, due in part to logistical difficulties, saw a recent one-day rally of over 54%.

These dynamics may be a factor in the Fed’s recent decision to increase the taper as well as an underpinning to Goldman Sachs’ sanguine perspective with regard to Inflation’s development in 2023.

Dynamic deserves deliberation

As always, Investors need to consider matters carefully; assessing opportunities against their own needs and risk involved, including “weaponization” (in any form).

*

Justin Jenk is a business professional who enjoys discovering and connecting dots.